Ted indicates financial stress rising

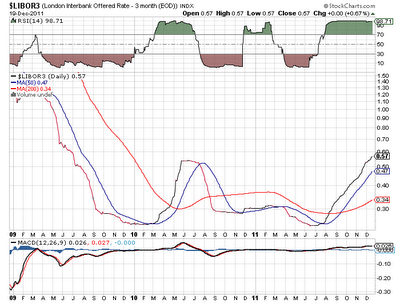

Libor indicates financial stress rising too.

SSEC shows Chinese economy running out of gas

BDI after a bounce it goes sideways at a low level

Brent crude trending slightly down

Copper shows another downtrend

Wheat shows a downtrend for nearly a year. It was at $1200 back in 2008, now down to the upper-mid $500 range

Iranians Rush to Buy Gold, Dollars as Sanctions Tighten Grip - Businessweek

ReplyDeleteThe average rate offered at currency exchange bureaus was about 15,300 rials per dollar, meaning the currency has lost about 15 percent of its value in a month, the Donya-e-Eqtesad newspaper said yesterday. The official rate yesterday was 11,030 rials per dollar, according to the Central Bank’s website. No rates were available for today, when Iran’s weekend began.

http://www.businessweek.com/news/2011-12-22/iranians-rush-to-buy-gold-dollars-as-sanctions-tighten-grip.html

That is an interesting development Bill. I hope the military is not planning on something to "help" the Iranians in addition to sanctions. These guys are the descendants of the ancient Persians. Not guys we want to be trifling with.

ReplyDeleteThanks PW for another great year of commentaries and analysis, although I remain agnostic on all that astrological stuff ;)

ReplyDeleteMerry Christmas!

John T.

Thanks for your Christmas wishes John. And the same to you and yours.

ReplyDeleteSenators to AG Holder - use every resource available.

ReplyDeletehttp://www.btrtrading.com/Press/Letter_DOJ_Baccus.htm

A very Merry Christmas to you PW.

Bill your link to the press letter is very important. I encourage everyone to read it as the MF Global bankruptcy is possibly the most significant event exposing the extreme levels of corruption evident in this country.

ReplyDeleteI hope to complete a post on this soon.

PW, about MF Global. It appears to be the first body to be washed up onto the beach as a result of the ongoing debacle in Europe, as Hedge Fund Manager Kyle Bass noted recently. Without a doubt 2012 will uncover many more.

ReplyDeleteJohn T