From Bloomberg:

Jobless Claims in U.S. Rose to Highest Since November

Comments:

This confirms anecdotal evidence that I have seen. Both corporate and consumer sentiment are changing, becoming more pessimistic.

It will be interesting to see what the Fed and Treasury pull out of their collective bag of tricks to attempt to convince the masses that "recovery is around the corner" before mid term elections. As mentioned before, I expect some type of large scale QE program to be announced by the FOMC on Sept 21st.

Given the present turmoil, my September/October stock market targets are as follows:

S&P 500 target - 875

Dow target - 8100 to 8200

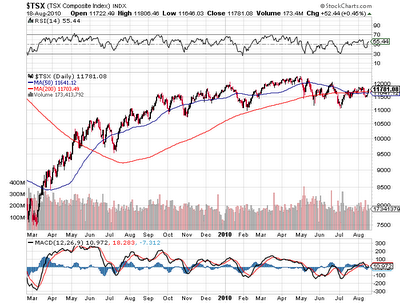

TSX target - 9600

Ouch!

Will QE have a large impact and reduce the possibility of a correction of this magnitude?

We will see. My suspicion is that with the change in sentiment even QE will not overcome the decline.

Jobless Claims in U.S. Rose to Highest Since November

Applications for unemployment benefits in the U.S. unexpectedly increased last week to the highest level since November, showing companies are stepping up the pace of firings as the economy slows.

Initial jobless claims rose by 12,000 to 500,000 in the week ended Aug. 14, Labor Department figures showed today in Washington. Claims exceeded all estimates of economists surveyed by Bloomberg News and compared with the median forecast of 478,000. The number of people receiving unemployment insurance fell, while those getting extended benefits increased.

A cooling economy may be discouraging employers from adding staff and prompting some to step up dismissals, raising the risk consumer spending will weaken more. The Federal Reserve said last week that the recovery would probably be “more modest” than anticipated, reflecting in part a jobless rate that’s restraining incomes.

Comments:

This confirms anecdotal evidence that I have seen. Both corporate and consumer sentiment are changing, becoming more pessimistic.

It will be interesting to see what the Fed and Treasury pull out of their collective bag of tricks to attempt to convince the masses that "recovery is around the corner" before mid term elections. As mentioned before, I expect some type of large scale QE program to be announced by the FOMC on Sept 21st.

Given the present turmoil, my September/October stock market targets are as follows:

S&P 500 target - 875

Dow target - 8100 to 8200

TSX target - 9600

Ouch!

Will QE have a large impact and reduce the possibility of a correction of this magnitude?

We will see. My suspicion is that with the change in sentiment even QE will not overcome the decline.

Comments

Post a Comment